How to choose the right wealth vehicle

There’s a vast range of vehicles that you can use to help grow your financial wealth for your later years and retirement.

Whichever one or combination you choose, it’s important to understand the risks of each vehicle and make a choice based on your preferences, risk tolerance, and the greatest chance of success. So how do you go about choosing the right wealth vehicle on your path to achieving your retirement goals?

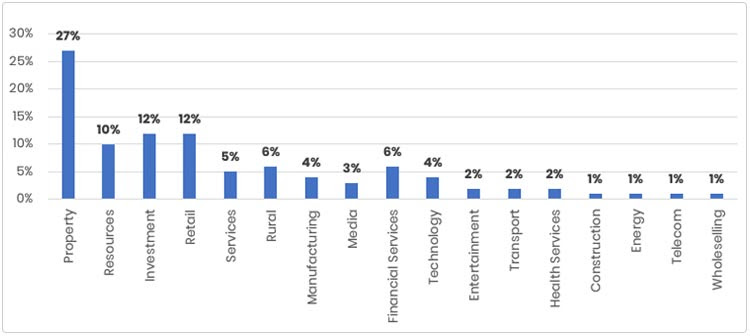

Let’s take a look at the sources of wealth in the chart below from the world’s richest people.

If you look at many studies done over the past few decades on investment growth and returns, property strongly stands out as one of the top wealth-building vehicles. But why is that?

Security

The residential property market offers security with ‘bricks and mortar’ when compared to other fluctuating more paper assets.

The growth pattern of property in Australia has stayed pretty constant over the past century, historically doubling in value every eight to ten years and this will continue as population growth increases in desirable locations.

Performance

The median house price over the past 20 to 25 years has increased by between 8% and 11% per annum in most Australian capital cities, even more interesting then that in the 1980’s the standard house land size was 1,000m², however, the standard lot size today has decreased to 450m². Meaning despite median house prices increasing, the land sizes have been decreasing, demonstrating an even higher return on investment.

Leverage

The simple point to make with property and leverage is that no other wealth vehicle will allow you to borrow 80% of the value, to as much as 100% or more.

Leverage is a mechanic that allows you to use less to do more, more specifically you can use a small amount of money to acquire an asset of much larger value. This is great news because you don’t have to already be wealthy to build wealth for your retirement.

Next steps

With all that, you also don’t need to only stick with one wealth vehicle, in fact, good diversification across multiple wealth-building vehicles is a great idea.

Be sure to use the vast amount of resources available to you and seek advice from a financial adviser or a good mentor with proven success. You can also take our quick and free online test to see if you’re making key property mistakes and how to fix them.

0 Comments